Home insurance includes coverages that help pay for the replacement or repair of your house and belongings if certain risks, like fire or theft, cause damage to them. It may also help with costs if you inadvertently damage someone else’s property or if a visitor is hurt while staying at your house.

How much does home insurance cost?

The cost of your home insurance depends on some variables, such as the coverages you choose, the features of your home, and the value of your personal property. Increased coverage limits or additional coverage may come at an additional cost. In addition to helping you choose coverages that meet your needs, your insurance provider can also help you ascertain whether you qualify for any possible policy discounts.

What is covered by home insurance?

Generally, home insurance covers the following:

- Your home

- Any other buildings on your property

- Personal belongings

Liability for injuries or damage to another person’s property

There might be options for additional coverage for better protection. Ordinarily, standard home insurance policies cover damage from things like hail, windstorms, lightning strikes, and fires. It’s important to remember that some natural disasters, like floods and earthquakes, are not covered. You may be able to purchase additional insurance policies to protect your house and belongings from these particular risks.

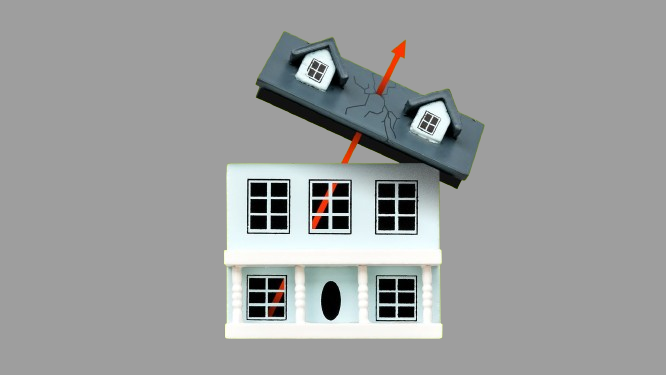

Protection for the dwelling

Dwelling protection is a basic coverage in a home insurance policy that helps to protect your home’s structure, including the walls, roof, and foundation. It might also go so far as to protect attached buildings from specific dangers, such as a deck or garage.

Protection for other structures

A detached garage, tool shed, or fence are examples of structures on your property that are not included in your primary residence and are typically covered by home insurance policies.

Protection for personal property

In addition to protecting your house from damage, home insurance also offers protection for the personal belongings that are kept inside. For instance, personal property protection can assist in covering the cost of replacing or repairing your electronics in the event of theft or fire damage to your furniture. Valuables such as jewelry, watches, and furs that surpass the standard limits of personal property coverage frequently have optional coverage available.

Liability protection

Liability coverage is included in a typical home insurance policy if a visitor is hurt on your property. For example, bodily injury liability coverage can help pay for your legal costs if a guest trips over a broken porch step, or it can pay for the visitor’s medical bills if you are found to be at fault. Your agent can help you navigate the options so that you can potentially improve your liability coverage by adding a personal umbrella policy.

Coverage limits and deductibles

It is crucial to understand that every coverage in a home insurance policy has a limit, which is the highest amount that the policy will pay for a loss that is covered. It is possible to modify coverage limits according to various factors, such as the value of your home and the cost of replacing or repairing damaged items. In addition, there is usually a deductible that you must pay before your insurance benefits kick in for a loss. Consult your policy or get in touch with your insurer to review and possibly adjust the deductible and coverage amounts to suit your needs.

When unanticipated events happen, the protections offered by a home insurance policy can serve as a safety net. You can choose appropriate coverage types and limits with the help of your insurance provider.